What Is Medigap Plan L, or Medicare Supplement Plan L?

Key Takeaways

- Medigap Plan L is a type of Medicare Supplement (Medigap)Medicare Supplement Insurance (Medigap) is designed to provide coverage that Original Medicare (Parts A and B) does not. Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you’ll need to pay. plan.

- Medicare Supplement plans are purchased from private insurance carriers to be used with Original MedicareOriginal Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). .

- Medigap Plan L can help offset certain medical expenses you might have after Medicare covers its share.

- You cannot purchase Plan L or other Medigap plans if you have a Medicare AdvantageA Medicare Advantage (Medicare Part C) plan is offered by a private insurance carrier to substitute for Original Medicare (Parts A and B). A Medicare Advantage plan must at least match the coverage you would receive from Original Medicare and may include additional benefits. Details vary by plan, and plan availability depends on your ZIP code. plan.

Medicare Supplement Insurance (also called Medigap) helps pay for the out-of-pocket expenses associated with Medicare, such as coinsurance, copayments, and deductibles. Compared to the nine other Medigap plan types available in most states, Medigap Plan L provides moderate coverage. Because of this, Plan L may offer lower monthly premiums. Unlike most other Medigap plans, Plan L comes with an out-of-pocket limit.

Medigap at a Glance

Medicare Supplement Insurance covers some of the out-of-pocket expenses — such as deductibles, copays, and coinsurance — left over when using Original Medicare (also called Medicare Parts A and B). To help bridge those gaps in Medicare coverage, beneficiaries can purchase a Medigap plan from a private insurance carrier.

More than 40% of Original Medicare beneficiaries had Medigap plans in 2022. There are 10 standardized Medigap plan types available in most states, each with different levels of coverage. Relative to other offerings, Plan L falls in the middle in terms of coverage. Unlike most other types of Medigap, Plan L sets an out-of-pocket limit.

Understanding Medigap Plan L

Medicare Supplement Plan L pays for a portion of the coinsurance, copayments, and other out-of-pocket costs associated with Medicare. Plan L is often compared to Plan K because those two Medigap plan types are the only ones with out-of-pocket limits.

Key Features of Medigap Plan L

- Part A coverage: Plan L pays 100% of coinsurance and hospital costs for up to 365 days after using your Medicare benefits.

- Part A benefits: The plan also pays 75% of the coinsurance or copayment for hospice, of the coinsurance for a skilled nursing facility, and of the deductible.

- Part B coverage: Plan L pays 75% of coinsurance and copayments after you meet the Plan B annual deductible.

- Out-of-pocket limit: $3,610 in 2025

What Does Medigap Plan L Cover?

Medigap benefits are limited to the scope of Original Medicare; they simply bridge gaps in coverage. Other Medigap plan types offer more robust coverage than Plan L, but Plan L sets a limit on out-of-pocket expenses. Plan K is the only other Medigap plan with that benefit.

Coverage offered under Medigap Plan L includes:

- 100% of Part A coinsurance and hospital costs for an additional 365 days after using Medicare benefits

- 75% of Part B copays and coinsurance

- 75% of the cost for the first three pints in a blood transfusion

- 75% of Part A hospice care copays and coinsurance

- 75% of skilled nursing facility care coinsurance

- 75% of the Part A deductible

Plan L does not help pay for:

- The Part B deductible

- Any excess costs that a healthcare provider charges on top of the Medicare-approved amount for care covered by Part B

- Emergency care during travel outside of the U.S.

Costs for Medigap Plan L

If you’re a Medicare beneficiary and you want to supplement your coverage with a Medigap plan, you’ll have to purchase Medicare Supplement Insurance from a private insurer. Though Plan L benefits are standardized across providers, different insurance carriers may sell the same plan at different prices, with costs differing based on your location, age, sex, and health status.

Here’s what you should know about the costs associated with Medigap Plan L.

- Premiums: Insurance companies determine their own premiums for Plan L policies even though they offer the same benefits. Premiums may be community-rated, which means they cost the same for everyone; issue-age-rated, in which the price is based on your age when you enroll; or attained-age-rated, in which the price goes up as you grow older.

- Deductibles: The deductible is the fixed amount you must pay out of pocket for covered medical expenses before your Medicare benefits kick in. Plan L pays for 75% of the Medicare Part A deductible. It does not pay any of the Part B deductible.

- Copays: A copay is a set amount you must pay out of pocket when using your coverage for certain services. Plan L pays for 75% of Part B copayments and 75% of Part A hospice care copayments.

- Coinsurance: Coinsurance functions similarly to copayments, but your OOP medical expenses are determined based on a percentage of your total cost of care rather than a fixed amount. Plan L pays for 100% of coinsurance costs for hospital stays of up to 365 days, 75% of Part B coinsurance, and 75% of Part A hospice care coinsurance.

- Out-of-pocket limit: The out-of-pocket limit is the maximum amount you must pay for covered medical services when using your Medigap benefits. Plan L is one of only two Medigap plan types with an out-of-pocket limit. For 2025, it’s $3,610.

See It in Action

Say you have Original Medicare and Medigap Plan L, and you undergo a scheduled, inpatient total knee replacement surgery. You stay in the hospital for two days following the surgery. Here’s how your costs might break down after using your benefits.

Treatment | Upfront cost | Medicare coverage | Plan F coverage |

Total knee replacement surgery | $20,000 | 80% after $1,676 Part A deductible (OOP cost reduced to $5,340) | 75% of Part A deductible, 100% of Part A coinsurance and hospital costs (OOP cost reduced to $419) |

Hospital room and board (two days) | $5,500 | 100% with Part A deductible met (OOP cost reduced to $0) | N/A |

Follow-up physical therapy (10 sessions) | $1,000 | 80% after $257 Part B deductible (OOP cost reduced to $405) | 75% of Part B coinsurance (OOP cost reduced to $212) |

The above example illustrates potential costs in a hypothetical scenario. Actual costs depend on your specific location, plan, and medical services.

How To Choose a Medigap Plan

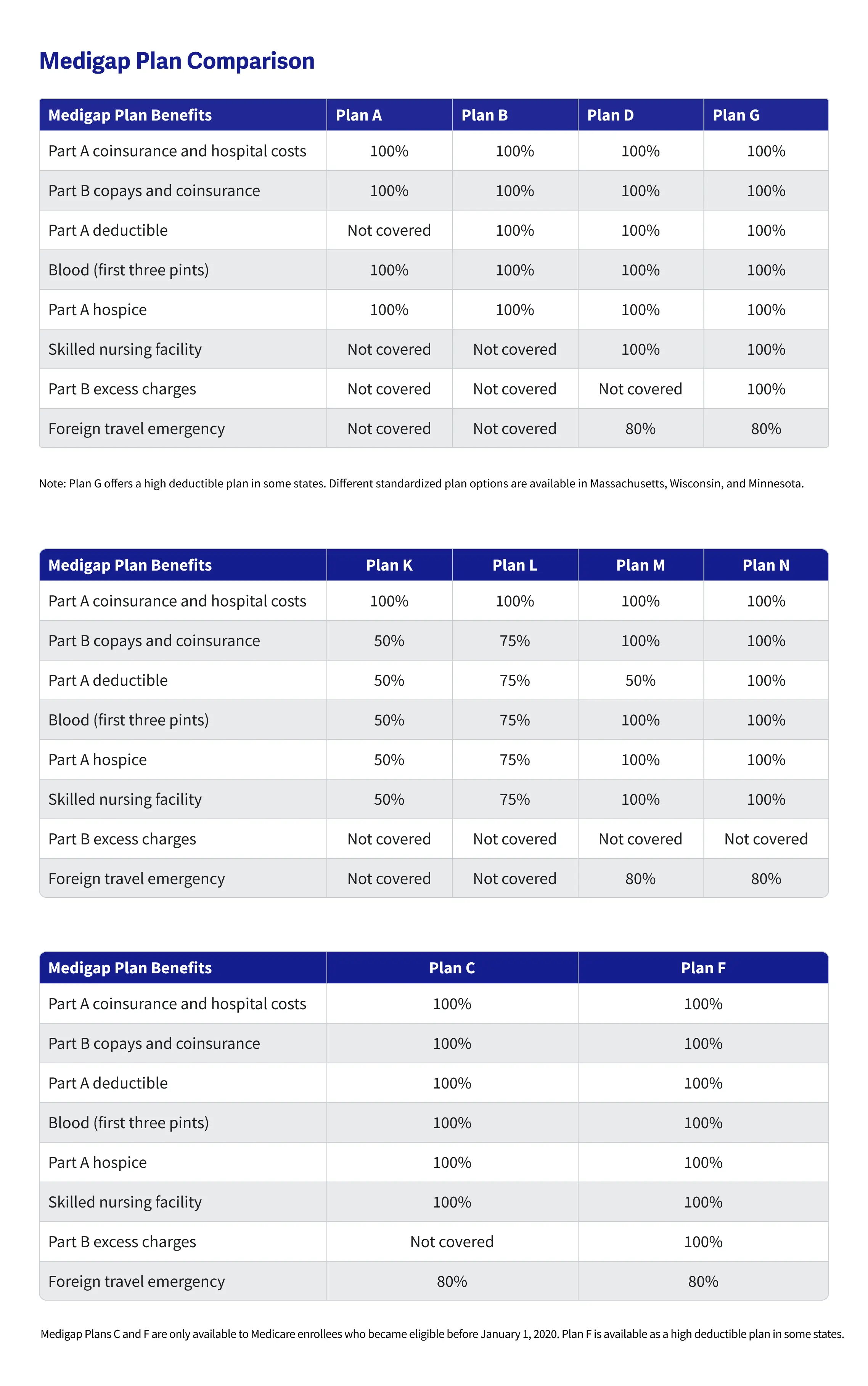

Most states offer 10 types of Medigap plans: A, B, C, D, F, G, K, L, M, and N (Plans C and F are no longer available if you turned 65 on or after January 1, 2020). All types of Medicare Supplement Insurance work with Original Medicare to cover out-of-pocket expenses like copays, coinsurance, and deductibles.

To choose the best Medigap plan for your budget and medical needs, you’ll have to:

- Assess your health status. Estimate how often you anticipate needing medical care. Plan L offers only moderate coverage, so it may work best for beneficiaries who do not require medical care often.

- Evaluate your budget. Compare premium prices among the plans available in your area. Consider which offerings fit into your budget. Because of its mid-level coverage, Plan L usually has lower premium prices.

- Compare insurance providers. Evaluate the private insurance companies in your area offering Plan L policies. Read reviews from reputable websites online. Meet with your trusted medical providers and ask their opinions.

It’s easiest to enroll in Medigap when you first enroll in Original Medicare and have Guaranteed Issue Rights. That means you cannot be charged a higher premium based on a health condition.

Enrolling in Medicare triggers your Medigap initial enrollment period, which starts on the first day of the month when you are 65 or older and enrolled in Medicare Part B. If you miss this initial enrollment period, you can still enroll in Medigap, but your premium may be higher.

Putting It All Together

Medigap Plan L offers mid-level coverage of deductibles, copays, coinsurance, and other out-of-pocket expenses associated with Original Medicare.

You can expect Plan L to pay for 75% of your out-of-pocket costs for many covered benefits; the plan also sets an out-of-pocket limit. Because Plan L’s coverage is relatively limited, premium prices tend to cost less for this type of Medicare Supplement Insurance.

Choosing the right Medigap plan can be a complex decision. Consider consulting a licensed agent or insurance broker for expert guidance.

Sources

- Costs of Medigap Policies.. Medicare.gov.

- K & L Out-of-Pocket Limits Announcements.. CMS.gov.

- Key Facts About Medigap Enrollment and Premiums for Medicare Beneficiaries. KFF.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.